Portugal's 2026 labour market combines historically low unemployment around 6.0-6.3%, modest wages by EU standards, regional asymmetries between coastal metropolitan areas and interior regions, and gradual demographic ageing that will tighten labour supply and intensify skills shortages over time.

Disclaimer: This article provides a qualitative overview of hiring trends based on publicly available labour market statistics, economic forecasts, and institutional analysis. It is intended to support understanding and workforce planning rather than formal forecasting or statistical prediction. This assessment reflects conditions and projections as of late 2025; labour market outcomes may vary by region and evolve with economic or policy changes.

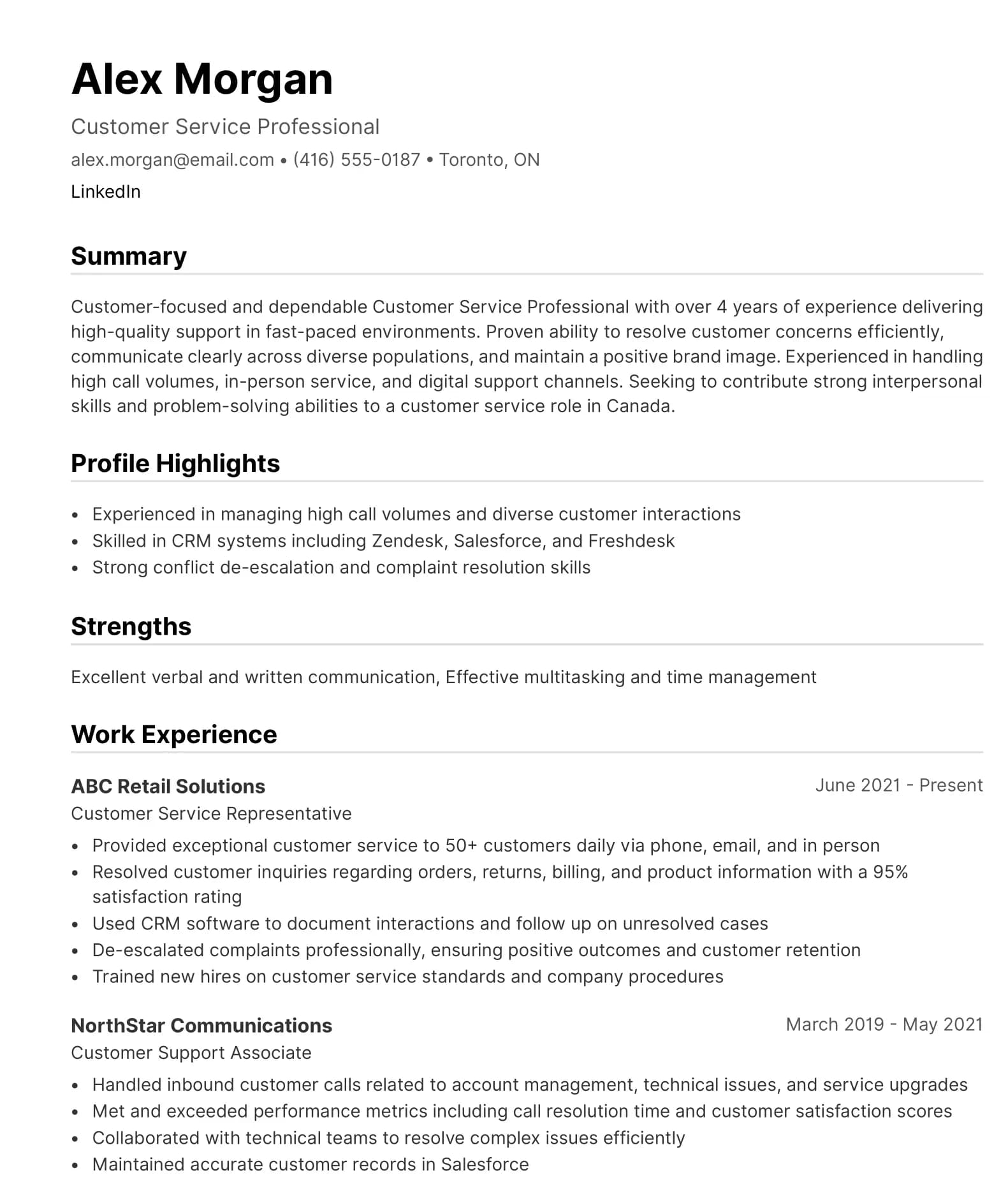

ATS-Optimized resumes That Meet Employer Standards

Our AI-powered scoring system helps organizations assess and standardize resume quality at scale. ATS-compliant templates support consistent formatting, keyword alignment, and interview readiness across cohorts.

Portugal's labour market in 2026 demonstrates remarkable recovery from sovereign debt crisis devastation. Unemployment rate has hovered around 6.0-6.3% in 2025, down from peaks near 18% in 2013, with latest readings around 5.9-6.1%—among the lowest in more than two years and approaching levels typically associated with full employment.

This corresponds to roughly 330,000-350,000 unemployed people in labour force of approximately 5.4-5.6 million, giving employment rate for ages 20-64 in mid-70% range, slightly above EU average. This represents complete transformation from crisis years when unemployment exceeded one million and employment rates languished.

However, recovery occurs alongside persistent wage challenges and emerging demographic constraints. Average annual pay for full-time worker stood at approximately EUR 24,800 in 2024—roughly EUR 2,070 monthly before tax—placing Portugal among lower-paid EU countries, approximately 35-40% below EU-27 median wage level.

Wages have been rising faster than EU average since 2022 (around 7-8% yearly) but from very low base. Debates continue about "low-wage competitiveness" model versus need to retain talent and cope with higher living costs, especially in Lisbon and Porto. Portugal maintains national minimum wage (approximately EUR 910-1,000 monthly in 2024-2025 depending on updates), and significant share of workers earn close to that threshold, particularly in hospitality, retail, agriculture, and basic services.

Population stands at around 10.6 million, with working-age share (15-64) just under 63-64% and gradually shrinking as country ages. Projections suggest working-age population could decline by 10-15% by 2040, while share of over-65s rises from approximately 24% to nearly 30%, implying growing replacement demand even if overall job growth remains modest.

This analysis is most relevant to employers, HR professionals, job seekers, training providers, policymakers, and institutions supporting workforce development in Portugal's recovering, wage-challenged, demographically ageing labour market.

1. Unemployment recovery complete: From 18% crisis peak to 6%

Portugal's unemployment transformation represents one of Southern Europe's most successful labour market recoveries, though wage and quality challenges persist.

Current unemployment 6.0-6.3%: Unemployment hovering around 6.0-6.3% in 2025, with latest readings 5.9-6.1%, represents approximately 330,000-350,000 unemployed in labour force of 5.4-5.6 million.

Crisis peak context: 2013 unemployment reached approximately 18% during sovereign debt crisis, representing over 900,000 unemployed. Youth unemployment exceeded 40% at peak. Current levels represent recovery of historic proportions comparable to Greece and Spain.

Near-full employment: Unemployment around 6% typically considered approaching full employment by economic standards, indicating most workers seeking jobs can find positions within reasonable timeframes.

Employment rate mid-70%: Employment rate for ages 20-64 in mid-70% range places Portugal slightly above EU average, indicating successful labour market activation compared to crisis years when rates fell below 65%.

Youth unemployment normalised: Youth unemployment (15-24) declined from 40%+ peaks to more sustainable levels, though still elevated compared to overall rate, indicating young Portuguese face greater difficulty entering labour market but improvement dramatic.

Long-term unemployment declining: Share of unemployed seeking work for 12+ months fallen substantially, indicating labour market fluidity improved and workers finding positions faster than during crisis.

Regional variation: Lisbon, Porto, and Algarve show lower unemployment than national average; interior regions experience higher rates, particularly outside tourist season.

So what

For candidates: Recovery creates best employment prospects in over a decade; however, wage levels and job quality remain concerns despite abundant opportunities.

For employers: Tight labour market creates recruitment challenges for skilled positions but improved economic conditions support business expansion and investment.

For policymakers: While unemployment recovery remarkable, must address wage stagnation, skills shortages, regional disparities, and demographic headwinds to sustain improvement.

2. Wages remain low by EU standards despite recent growth

Portugal's wage structure reflects Southern European pattern of lower compensation despite economic recovery and recent improvements.

Average wage EUR 24,800 annually: Average annual pay for full-time worker approximately EUR 24,800 in 2024 (roughly EUR 2,070 monthly before tax) places Portugal among lower-paid EU countries, approximately 35-40% below EU-27 median wage level.

International comparison: Portuguese wages substantially below northern Europe (Germany EUR 50,000+, Nordic countries EUR 45,000-55,000+), below western Europe (France EUR 40,000+, Belgium EUR 55,000+), and comparable to or slightly below other Southern European countries (Spain EUR 28,000-30,000, Greece EUR 20,000-24,000).

Wage growth accelerating: Wages rising faster than EU average since 2022 (approximately 7-8% annually) represents improvement, but growth from very low base means absolute wage levels remain modest.

Minimum wage EUR 910-1,000 monthly: National minimum wage approximately EUR 910-1,000 monthly (2024-2025, subject to periodic updates) represents floor, but substantial share of workforce earns at or near minimum.

Sectoral concentration at minimum: Hospitality, retail, agriculture, personal services, and basic positions frequently pay minimum wage or slightly above, creating large population of workers earning EUR 900-1,200 monthly.

Sectoral variation:

- Hospitality and tourism: Often minimum wage to EUR 1,200-1,500

- Retail and services: EUR 1,000-1,500 monthly

- Public sector: EUR 1,500-3,000+ depending on position

- Professional services (IT, engineering, finance): EUR 2,000-4,000+

- Senior specialists and managers: EUR 3,000-6,000+

Low-wage competitiveness debate: Some argue low wages provide competitive advantage attracting foreign investment and tourism; others contend wages insufficient for retention, talent attraction, and living standards, particularly given Lisbon/Porto cost of living.

Brain drain driver: Low wages relative to northern Europe create emigration incentive for young professionals, particularly those with technical skills and language abilities, seeking 2-3x compensation abroad.

So what

For candidates: Wage expectations must account for Portuguese reality; professionals with international mobility face substantially higher earnings abroad; those remaining must balance lower income against lifestyle, climate, culture factors.

For employers: International competition for talent requires creative approaches; while cannot match northern European wages, offering quality of life, work-life balance, and development opportunities helps retention.

For policymakers: Wage growth essential for retention and living standards; productivity improvements, upskilling, sectoral upgrading, and movement from low-wage tourism/services to higher-value activities support sustainable wage increases.

3. Demographic ageing will tighten labour supply

Portugal faces accelerating demographic ageing creating long-term labour market constraints and replacement demand challenges.

Working-age population declining: Working-age share (15-64) currently just under 63-64% of 10.6 million population and gradually shrinking as country ages.

10-15% decline by 2040: Projections suggest working-age population could decline by 10-15% by 2040, representing loss of approximately 650,000-950,000 potential workers over 15 years.

Elderly share rising: Share of over-65s expected to rise from approximately 24% currently to nearly 30% by 2040, creating one of Europe's oldest populations alongside Italy, Greece, and Spain.

Dependency ratio deteriorating: Fewer workers supporting more retirees creates fiscal pressures on pensions, healthcare, and social services while reducing labour supply.

Replacement demand: Even modest economic growth requires substantial recruitment merely to replace retiring workers, before accounting for expansion or new positions.

Youth cohorts smaller: Low fertility (approximately 1.3-1.4 children per woman, well below replacement 2.1) ensures declining working-age population continues beyond 2040 absent substantial immigration.

Emigration compounds: Brain drain of young professionals to northern Europe, UK, Switzerland, and Luxembourg further reduces reproductive-age population and accelerates ageing.

Regional variation severe: Interior regions already feature elderly populations with median ages exceeding 50; coastal metropolitan areas younger but also ageing as youth migrate internally and internationally.

So what

For candidates: Demographic decline creates long-term labour scarcity, potentially improving bargaining power for workers who remain; however, economic growth constraints from smaller market may limit opportunities.

For employers: Predictable future talent scarcity requires retention strategies, productivity improvements, automation where appropriate, immigration support, and planning for workforce ageing.

For policymakers: Demographic trajectory represents existential challenge requiring fertility support (though effects delayed), immigration facilitation, retention of young talent, extended working lives, and productivity improvements offsetting smaller workforce.

4. Tourism dependence creates opportunities and vulnerabilities

Portugal's economic recovery heavily driven by tourism sector creating employment but also seasonal volatility and wage constraints.

Tourism sector prominence: Tourism and related hospitality, restaurants, transport, retail, and services represent substantial share of Portuguese employment, particularly in Lisbon, Porto, Algarve, and coastal regions.

Seasonal employment patterns: Many tourism-related positions operate seasonally (April-October peak), creating income volatility and winter unemployment for seasonal workers.

Wage levels modest: Tourism and hospitality frequently pay minimum wage or slightly above (EUR 910-1,500 monthly), with tips providing variable additional income. Limited career progression and benefits create challenges retaining workers.

Geographic concentration: Algarve heavily tourism-dependent; Lisbon and Porto feature tourism alongside other sectors; interior regions lack tourism employment base, contributing to regional disparities.

Quality concerns: Tourism employment often characterised by seasonal contracts, minimum wages, irregular hours, limited benefits, minimal advancement prospects, and physical demands.

Youth employment pathway: Tourism provides entry-level employment for young Portuguese but limited long-term career prospects, contributing to emigration as workers seek stable, better-paid positions abroad.

Vulnerability to shocks: Heavy tourism dependence creates vulnerability to external shocks (COVID-19 demonstrated dramatically), economic downturns, geopolitical tensions, or climate change affecting tourist flows.

Upmarket positioning efforts: Some initiatives promote luxury tourism, cultural tourism, and higher-value visitors requiring skilled workers and offering better wages, though mass tourism remains dominant.

So what

For candidates: Tourism sector provides accessible employment but seasonal nature and low wages limit long-term prospects; developing skills for year-round sectors improves stability.

For employers: Tourism businesses face labour shortages during peak season but limited ability to offer year-round employment; creative approaches around seasonal workers and skill development help retention.

For policymakers: Diversifying economy beyond tourism through technology, professional services, manufacturing, and renewable energy reduces volatility and improves employment quality.

5. Skills shortages emerging in technical and professional fields

Despite moderate overall unemployment, specific sectors face recruitment difficulties as available workforce doesn't match skills demanded.

Critical shortage areas:

- ICT and technology: Software developers, data scientists, cybersecurity specialists, cloud engineers, IT project managers face strong demand as digital transformation accelerates but supply insufficient.

- Healthcare: Doctors, nurses, allied health professionals experience shortages exacerbated by emigration to northern Europe, UK, and Switzerland offering 2-3x wages and better conditions.

- Engineering: Civil, mechanical, electrical, and industrial engineers needed for construction, infrastructure, renewable energy, but many emigrated or pursuing careers abroad.

- Construction trades: Electricians, plumbers, welders, HVAC technicians, skilled construction workers face shortages as sector rebounds and infrastructure projects expand.

- Renewable energy: Solar installation technicians, wind turbine specialists, energy efficiency experts needed for green transition but training pipelines underdeveloped.

- Social care: Care workers for ageing population increasingly scarce despite growing demand from demographic changes.

Education-employment mismatch: Universities produce graduates in fields with limited employment (some arts, general business) while underproducing engineers, technicians, healthcare professionals where demand exists.

Vocational training gaps: Technical and vocational education and training (TVET) systems less developed than university track, creating skilled trades shortages.

Brain drain exacerbates: Emigration of qualified doctors, engineers, IT professionals, and specialists perpetuates domestic shortages while training costs absorbed by Portuguese educational system benefit destination countries.

Language skills premium: English proficiency, French, German create employment advantages for tourism, international business, and emigration opportunities.

So what

For candidates: Technical qualifications in ICT, engineering, healthcare, trades provide access to best domestic opportunities and international mobility; general degrees face limited formal employment.

For employers: Skills shortages require creative recruitment (international hiring, training programmes, competitive packages), partnerships with educational institutions, and retention strategies against emigration pull.

For policymakers: Addressing skills mismatches requires education reform strengthening technical programmes, expanding vocational training, improving work-integrated learning, creating incentives for shortage-field study, and retention programmes.

6. Regional disparities: Coastal prosperity vs interior decline

Geographic location fundamentally shapes employment opportunities, wages, and economic prospects in Portugal.

Lisbon dominance: Greater Lisbon concentrates:

- Corporate headquarters and international businesses

- Professional services (finance, legal, consulting)

- Technology sector and startups

- Government employment

- Tourism and cultural industries

- Highest wages and most opportunities

Porto as secondary centre: Porto (second city) offers opportunities in commerce, manufacturing, technology, tourism, professional services but smaller scale than Lisbon.

Algarve tourism dependence: Algarve region heavily reliant on seasonal tourism creating summer employment boom but winter challenges.

Interior decline: Interior regions (Alentejo, much of Centro, interior Norte) face:

- Ageing populations (median age often 50+)

- Youth emigration to coast or abroad

- Limited formal employment beyond agriculture, public sector

- Declining services (school closures, reduced healthcare)

- Economic stagnation and population loss

Coastal advantage: Coastal regions generally feature better economic conditions, younger populations, more diverse employment, higher wages than interior.

Wage differentials: Lisbon and Porto wages typically 20-40% above interior regional equivalents; however, housing costs in Lisbon substantially higher, partially offsetting advantages.

Internal migration: Economic opportunities concentrate on coast (especially Lisbon-Porto corridor and Algarve), driving internal migration from interior creating demographic decline in already-challenged regions.

Infrastructure gaps: Interior regions feature inferior transport, digital connectivity, healthcare, education compared to coastal metropolitan areas, creating competitive disadvantages.

So what

For candidates: Geographic mobility towards Lisbon, Porto, or coastal regions substantially expands opportunities; interior residents face choice between limited local options or relocation.

For employers: Lisbon and Porto employers access largest talent pools but face most competition and highest costs; interior locations struggle attracting workers despite lower expenses.

For policymakers: Regional development, infrastructure investment in interior, remote work enablement, and economic activity decentralisation could distribute opportunities and slow depopulation of inland regions.

7. Brain drain persists despite recovery

Emigration of skilled young Portuguese continues despite labour market improvements, perpetuating skills shortages and demographic challenges.

Crisis-era emigration wave: During 2008-2015 economic crisis, hundreds of thousands of Portuguese emigrated seeking opportunities abroad, particularly young professionals and university graduates.

Primary destinations:

- Northern Europe: UK, Germany, France, Netherlands, Belgium, Switzerland, Luxembourg

- Former colonies: Brazil (though reversed recently), Angola, Mozambique

- Other: US, Canada, Australia

- Intra-EU mobility facilitated by freedom of movement

Skills concentration: Emigrants disproportionately include doctors, nurses, engineers, IT professionals, scientists, teachers, skilled trades, representing precisely skills Portugal needs.

Continuing despite recovery: While emigration rates declined from crisis peaks, significant outflows continue. Low wages, limited career prospects, high housing costs (Lisbon), and quality-of-life factors drive ongoing departures.

Return migration limited: Some Portuguese returning after gaining experience abroad, but return flows smaller than ongoing departures, creating net brain drain.

Youth overrepresented: Young professionals in 20s and 30s with university degrees and language skills represent largest emigrant demographic, draining workers needed for economic renewal.

Circular migration patterns: Some Portuguese maintain dual lives, working abroad parts of year while maintaining Portuguese residence, particularly in consulting, IT, creative work enabling remote arrangements.

Remittances positive but insufficient: Emigrant remittances provide income for families but don't offset economic contribution lost from departure of skilled workers.

So what

For candidates: International opportunities remain attractive given wage differentials (2-3x abroad); those with technical skills, languages, EU mobility benefit from option value while domestic opportunities exist for those prioritising lifestyle.

For employers: Competing with international opportunity pull requires offering competitive total rewards, career development, quality work culture, flexibility offsetting wage disadvantages.

For policymakers: Addressing brain drain requires raising wages through productivity improvements, reducing housing costs, improving career opportunities, supporting return migration of experienced professionals, and creating conditions retaining young talent.

8. EU membership shapes opportunities and constraints

Portugal's EU membership fundamentally influences labour market through free movement, structural funds, regulations, and competitive pressures.

Free movement advantages: Portuguese workers access entire EU labour market, enabling emigration to higher-wage northern Europe. Conversely, Portugal can recruit from EU for shortage fields, though limited inflows given wage levels.

Structural and cohesion funds: EU funding supports infrastructure, business development, training programmes, regional development, providing investment capacity beyond Portuguese fiscal limitations.

Euro constraints: Euro membership eliminates independent monetary policy and currency devaluation, requiring internal adjustment during crisis with painful employment consequences but providing price stability and trade benefits.

Regulatory alignment: EU labour law, health and safety standards, anti-discrimination rules, working time directives establish minimum standards, generally raising Portuguese workplace quality.

Competitive pressures: EU single market creates competition for investment, tourism, and economic activity. Portuguese businesses face European and global competitors, constraining wage growth and requiring productivity improvements.

Green transition requirements: EU climate goals and Green Deal create obligations around emissions reduction, renewable energy, building efficiency, requiring investment but also creating green jobs.

Digital agenda alignment: EU digital transformation priorities and funding support Portuguese digitalisation, e-government, connectivity, technology sector development.

Recovery and Resilience Facility: EU pandemic recovery funding provides substantial resources for investment in digital transition, climate action, and resilience, supporting economic transformation.

So what

For candidates: EU citizenship provides freedom to pursue opportunities across Europe; however, requires language skills, qualification recognition, willingness to relocate.

For employers: EU membership enables recruitment from broader talent pool (though limited given wage levels) and provides funding for training, development, business expansion.

For policymakers: Maximising EU membership benefits requires effective deployment of structural funds, recovery resources, regulatory alignment supporting competitiveness, strategies addressing disadvantages (low productivity, wages) while leveraging advantages (climate, tourism, location).

What this means in practice

For job seekers

- Develop technical and professional skills: ICT, engineering, healthcare, renewable energy, skilled trades provide best domestic opportunities and international mobility; general qualifications face limited prospects.

- Build language capabilities: English essential for tourism, international business, emigration; Spanish, French, German expand opportunities in EU.

- Consider geographic mobility: Lisbon and Porto offer vastly more opportunities than interior regions; international mobility provides wage multiples for skilled workers.

- Target growth sectors: Technology, renewable energy, healthcare, professional services offer better prospects than traditional tourism and low-skill services.

- Pursue EU-recognised qualifications: International certifications and qualifications facilitating recognition across EU provide mobility options and career insurance.

- Balance domestic vs international trade-offs: Weigh 2-3x wage potential abroad against climate, lifestyle, culture, family, lower stress; neither choice universally superior.

For employers

- Invest in retention: Given brain drain pressures, retaining skilled employees requires competitive compensation by Portuguese standards, career development, positive culture, work-life balance.

- Partner with educational institutions: Collaborating on curricula, providing internships, developing recruitment pipelines addresses skills gaps and improves access to qualified graduates.

- Consider international recruitment: For shortage fields, recruiting from Brazil, Portuguese-speaking Africa, other EU countries may be necessary; supporting integration enables success.

- Develop seasonal workers strategically: Tourism businesses might explore off-season employment alternatives, training programmes, or retention approaches reducing seasonal volatility.

- Leverage EU resources: Accessing structural funds, recovery resources, training support for business development, workforce upskilling, and expansion.

For training providers and educational institutions

- Expand technical and vocational programmes: Critical shortages in engineering, ICT, healthcare, trades require substantially expanded capacity rather than continuing general programme proliferation.

- Strengthen work-integrated learning: Internships, apprenticeships, practical projects address employer work-readiness concerns and improve graduate employment outcomes.

- Develop international partnerships: Erasmus and other EU programmes enable student mobility, international experience, qualification recognition supporting career prospects.

- Focus on shortage fields: Aligning programmes with employer needs in technology, engineering, healthcare, renewable energy, skilled trades improves graduate outcomes.

- Build language and soft skills: English, communication abilities, teamwork, problem-solving essential for modern employment across sectors.

For policymakers

- Address demographic decline comprehensively: Fertility support (though effects delayed), immigration facilitation, retention of young talent, extended working lives, productivity improvements all necessary to offset 10-15% working-age decline.

- Raise productivity to support wages: Infrastructure investment, digitalisation, skills upgrading, business environment improvements enable productivity gains funding wage growth essential for retention.

- Diversify beyond tourism: Supporting technology, professional services, manufacturing, renewable energy, creative industries provides year-round quality employment reducing seasonal volatility.

- Reduce regional disparities: Infrastructure investment, economic incentives, remote work enablement for interior regions distributes opportunities and slows coastal concentration.

- Facilitate brain circulation: Supporting return migration, enabling circular mobility, creating conditions attracting skilled immigrants, and improving retention of young professionals.

For all stakeholders

Platforms like Yotru can support these strategies by making skills visible, standardising employer-ready CVs at scale, helping institutions measure learner job readiness, and enabling employers to identify candidates with the right applied experience for Portugal's recovering economy amid demographic headwinds and skills shortages.

Looking ahead: Recovery success meets demographic reality

Portugal's 2026 labour market demonstrates remarkable recovery. Unemployment at 6.0-6.3% versus 18% crisis peak, employment rate mid-70% slightly above EU average, and ongoing improvement represent transformation from economic crisis devastation comparable to Greece and Spain.

However, this recovery masks emerging challenges threatening to constrain future growth. Average wages EUR 24,800 annually (35-40% below EU median) drive continued emigration of skilled workers. Working-age population declining 10-15% by 2040 while over-65 share rises from 24% to 30% creates fundamental labour supply constraints.

Future outcomes depend on addressing fundamental constraints:

Wage growth acceleration: Moving from EUR 24,800 average towards EU median requires productivity improvements through digitalisation, skills upgrading, sectoral shift from low-wage tourism to higher-value activities, infrastructure enabling competitiveness.

Brain drain reversal: Current emigration perpetuates skills shortages and demographic decline. Raising wages, reducing housing costs (particularly Lisbon), improving career opportunities, supporting return migration essential for retention.

Demographic stabilisation: Raising fertility from 1.3-1.4 towards replacement (though effects delayed decades), facilitating immigration to offset population decline, extending working lives, maximising labour force participation all necessary.

Skills system transformation: Education-employment mismatches require comprehensive reform expanding vocational training, technical education, work-integrated learning, employer-education partnerships.

Economic diversification: Reducing tourism dependence through technology, renewable energy, professional services, advanced manufacturing provides year-round quality employment and reduces vulnerability.

Regional development: Addressing coastal-interior divide through infrastructure, economic incentives, remote work enablement distributes opportunities and slows depopulation of inland regions.

EU resource maximisation: Effective deployment of structural funds, Recovery and Resilience Facility resources, cohesion programmes accelerates transformation and addresses competitive disadvantages.

Productivity breakthrough: Modest wages partially reflect low productivity in tourism, services, agriculture; modernisation, digitalisation, capital investment, skills upgrading enable wage growth supporting retention.

Organisations and individuals who recognise Portugal's distinctive reality (dramatic recovery from crisis complete but wages remain low driving brain drain, favourable climate and lifestyle attracting some but inadequate for retention of all, demographic decline threatening to erase labour market gains, and coastal-interior divide creating dual labour market) will position themselves most effectively. Success requires moving beyond celebrating unemployment recovery to transforming wages, productivity, demographics, and economic structure. The next decade determines whether Portugal builds sustainable prosperity on crisis recovery foundation or demographic decline and brain drain undermine hard-won improvements.