Market

11 min read

California Jobs 2026: Hiring Trends + Salaries

Synopsis

Tech booms in AI while construction starves for workers. California's paradox job market demands strategic positioning—here's where opportunity actually exists in 2026.

Tech booms in AI while construction starves for workers. California's paradox job market demands strategic positioning—here's where opportunity actually exists in 2026.

California enters 2026 with 5.6% unemployment and an economy growing slower than the nation. UCLA Anderson Forecast projects recovery beginning late 2026, with unemployment potentially hitting 6.2% before improving. Tech sector shows strength in AI and specialized software roles, with San Francisco maintaining $195K average tech salaries.

Healthcare faces acute nursing shortages—California needs 106,000+ RNs by 2036. Construction desperately seeks 500,000 skilled workers nationwide, with California's tight labor market pushing wages higher. This creates opportunity pockets amid broader economic uncertainty.

California's market splits between AI-driven tech boom (senior engineers $200K+) and critical shortages in healthcare/construction ($50K-$150K). Choose sector wisely—credentials matter less than positioning.

Whether you're a California resident, recent graduate, or professional considering relocation, understanding which sectors actively hire versus which face headwinds matters. This guide explains where hiring concentrates, which skills command premiums, and how to position yourself with Yotru's resume builder for California's fragmented market.

| California 2026: labor market snapshot | ||

|---|---|---|

| Indicator | 2026 estimate | Job Outlook |

| Unemployment rate | 5.6% (Sept 2025); peak 6.2% projected early 2026 before recovery | Medium |

| Job vacancy level | Elevated in AI/tech, healthcare, construction; weak in admin/retail | Medium |

| Top shortage sectors | AI/ML engineering, nursing (106K shortage by 2036), skilled trades (500K national need), cybersecurity | High |

| Real wage trend | Tech: stagnant (+0.8%); Construction: strong (+8-10%); Healthcare: premium rates | Medium |

| Strongest profiles | AI/ML specialists, senior software engineers, registered nurses, electricians, plumbers, HVAC techs | High |

Sources: California EDD, UCLA Anderson Forecast, BLS, Robert Half 2026 Tech Salary Guide

In California’s job market, depth beats breadth. Employers prioritize proven skills and certifications over general experience.

Market reality: San Francisco commands $195K average tech salary—highest nationally. AI/ML roles taking 89 days to fill due to talent scarcity. Remote work declining except senior positions.

Salary in California:

Who's hiring:

What you need:

Job posting signals: "AI/ML," "LLM," "equity package," "remote-friendly," "senior+" (indicating selectivity)

California tech hiring favors shipped products over degrees. Portfolio with measurable impact beats credentials. Quantify everything: "reduced API response time 40%" > "worked on backend." Show GitHub, deployed apps, user metrics.

If you're applying from outside California:

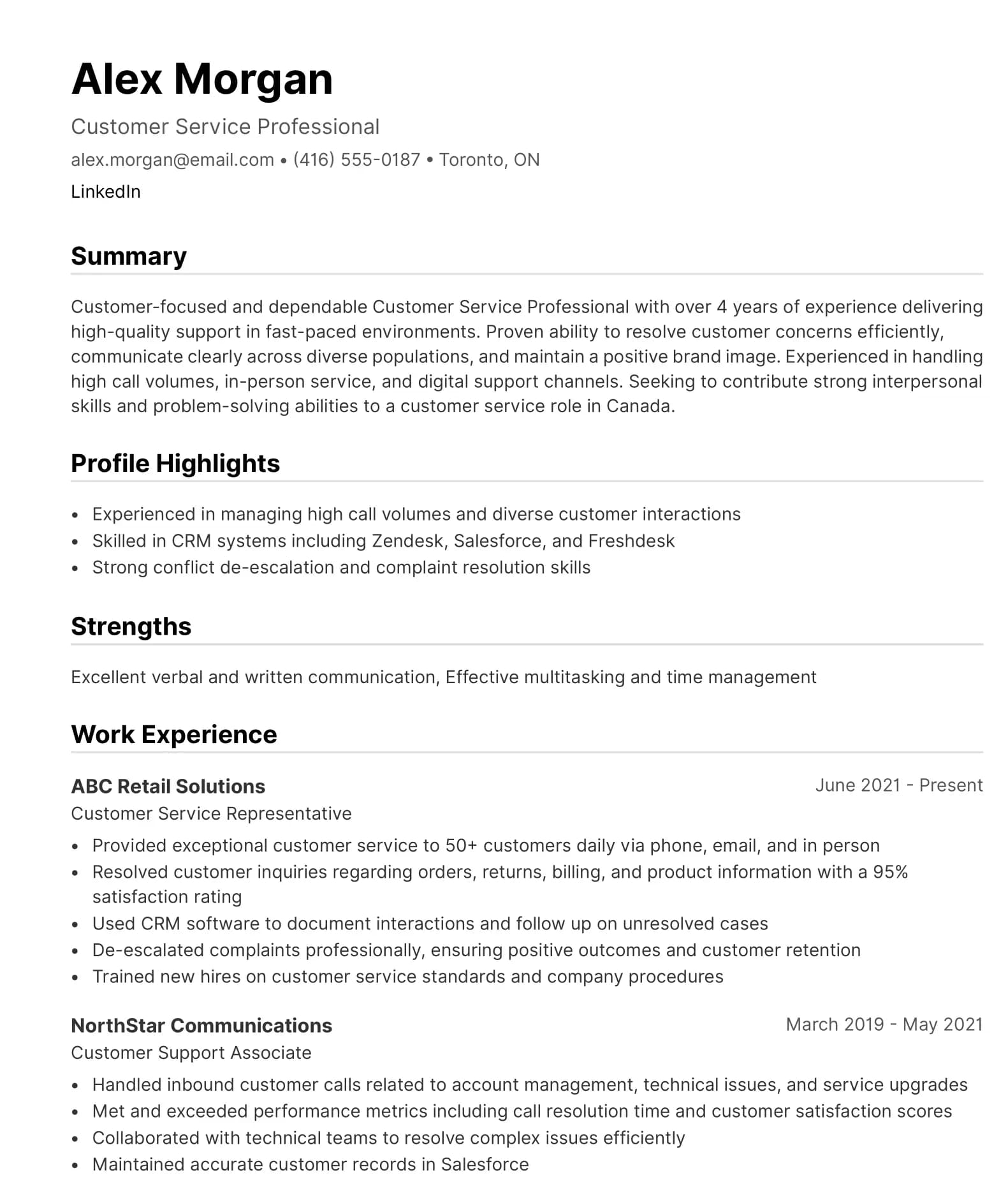

How Yotru helps: Yotru's resume builder emphasizes shipped projects over job titles, quantifies technical impact for California tech recruiters, formats for Big Tech ATS systems, highlights AI/ML specializations that command premiums.

Market reality: California projects 106,000 RN shortage by 2036—26% deficit, second-worst nationally. Burnout driving exits; aging population increasing demand. Rural counties critically short.

Salary in California:

Who's hiring:

What you need:

Job posting signals: "competitive differentials," "union facility," "BSN preferred," "bilingual bonus," "sign-on bonus $10K-$25K"

California nursing offers highest RN salaries nationally ($149K avg) but faces brutal patient ratios and burnout crisis. 47% report burnout symptoms. Evaluate facility culture, not just salary—turnover signals systemic problems.

If you're applying from outside California:

How Yotru helps: Highlights California-specific nursing credentials (BRN license, specialty certifications), emphasizes patient outcomes and bilingual capabilities, formats for healthcare ATS systems used by Kaiser/Sutter/UC systems.

Market reality: U.S. construction needs 500,000 workers; California's share significant. Aging workforce (41% retiring by 2031) creates vacuum. Infrastructure spending drives demand. Wages rising 8-10% to attract talent.

Salary in California:

Who's hiring:

What you need:

Job posting signals: "prevailing wage," "union scale," "Davis-Bacon," "OSHA 30," "journey-level," "per diem available"

California construction trades out-earn many college graduates when adjusted for zero student debt. Electricians/plumbers earn $70K-$95K after 4-year apprenticeship while peers graduate with $50K debt and $45K entry jobs. Do the math.

If you're applying from outside California:

How Yotru helps: Emphasizes trade certifications and safety training for California construction market, highlights union apprenticeship completion and specialized skills, formats for contractor screening processes.

Market reality: California leads nation in renewable energy adoption. Solar mandate for new homes drives installer demand. EV infrastructure expansion creates electrical/engineering needs. Green building codes require specialized skills.

Salary in California:

Who's hiring:

What you need:

Job posting signals: "NABCEP certified," "LEED AP," "Title 24," "CEC compliance," "prevailing wage" (government projects)

If you're applying from outside California:

How Yotru helps: Highlights renewable energy certifications for California's green economy, emphasizes Title 24 compliance and technical specializations, positions candidates for sustainability-focused employers.

What's changing in California's job market

Tech sector adding 900,000+ jobs in 2025 but shifting from development to AI/ML specialization. Software engineering now only 10% of in-demand tech roles. Cloud, data analytics, AI, and machine learning dominate. This means generic coding skills less valuable; specialized AI expertise commands massive premiums.

What this means:

California nursing shortage projected to hit 106,000 RNs by 2036. Current 25,000+ FTE gap closing slowly. Burnout driving 22.5% of RNs aged 55-64 to retire by 2027. Allied health (PT, OT, respiratory therapy) also facing shortages.

What this means:

41% of construction workforce retiring by 2031. Industry needs 500,000 new workers nationwide annually through 2026. Young workers avoiding trades despite competitive wages and zero debt.

What this means:

87% of tech companies hired globally for remote in 2024, but trend reversing. Return-to-office mandates increasing. Remote roles now concentrated in senior positions or specialized/hard-to-fill roles.

What this means:

California taxes hit hard:

Housing dominates budgets:

Calculate net take-home:

$150K tech salary in San Francisco = ~$90K after-tax = $7,500/month. Rent $3,500 = $4,000 remaining. Student loans, car, food, insurance, utilities leave little. $150K feels like $75K elsewhere.

Tech (SF Bay, LA):

Healthcare:

Construction:

Healthcare:

Construction trades:

Tech:

H-1B visa:

Other work visas:

Green card pathways:

California employers increasingly prefer U.S. work authorization to avoid visa complexity/cost. H-1B still available at Big Tech but smaller companies often pass. Green card process 3-7+ years depending on country of birth.

High opportunity:

Weak opportunity:

Tech:

Healthcare:

Trades:

Tech:

Healthcare:

Trades:

Use Yotru's resume builder to:

Don't just look at salary—calculate net:

California market allows negotiation:

California hiring moves fast in hot sectors (AI/ML, nursing, trades) but slow in others. Tech interviews: 2-4 weeks. Healthcare: 4-8 weeks (credentialing). Trades: 1-2 weeks (desperate for workers). Adjust timeline expectations accordingly.

Our AI-powered scoring system helps organizations assess and standardize resume quality at scale. ATS-compliant templates support consistent formatting, keyword alignment, and interview readiness across cohorts.

Technology, healthcare, clean energy, logistics, and advanced manufacturing are projected to remain the strongest sources of new jobs in California. Within those sectors, roles tied to AI, data, healthcare support, and green infrastructure show the most durable long‑term demand.

Team Yotru

Employability Systems & Applied Research

Team Yotru

Employability Systems & Applied Research

We bring expertise in career education, workforce development, labor market research, and employability technology. We partner with training providers, career services teams, nonprofits, and public-sector organizations to turn research and policy into practical tools used in real employment and retraining programs. Our approach balances evidence and real hiring realities to support employability systems that work in practice. Follow us on LinkedIn.

Continue exploring related perspectives on career development, hiring trends, and workforce change.

This guide is for job seekers navigating California’s fragmented labor market. It focuses on where real opportunities exist across tech, healthcare, construction, and clean energy, cutting through generic advice. You’ll find practical insight on pay realities, in-demand credentials, and regional trade-offs, helping you understand which roles are growing, which are saturated, and how to position yourself competitively in today’s market.

This analysis draws on publicly available data from California state agencies, U.S. federal labor statistics, university research centers, and industry associations. It integrates employment trends, sector-level demand indicators, and workforce projections to reflect current and emerging conditions in California's 2026 job market.

Salary figures reflect estimated annual gross earnings in U.S. dollars (USD) before taxes. Data is normalized using aggregated job postings, government labor statistics, industry salary surveys, and employer-reported ranges to account for geographic variation (SF Bay Area vs. LA vs. Inland Empire), role seniority, sector differences, and experience levels. Actual compensation varies based on employer type, location, negotiation, and total package (equity, bonuses, benefits).

Yotru provides factual labor market information to support informed career decisions. We do not guarantee employment outcomes. Information reflects conditions as of late 2025; verify current trends independently. We maintain editorial independence from employers, staffing agencies, and training providers.

This content is for informational purposes only and does not constitute legal, financial, immigration, or professional advice. Labor market conditions change; verify information independently before making career decisions. Individual results vary by qualifications, experience, and circumstances.

If you are working on employability programs, hiring strategy, career education, or workforce outcomes and want practical guidance, you are in the right place.

Yotru supports individuals and organizations navigating real hiring systems. That includes resumes and ATS screening, career readiness, program design, evidence collection, and alignment with employer expectations. We work across education, training, public sector, and industry to turn guidance into outcomes that actually hold up in practice.

Part of Yotru's commitment to helping professionals succeed in real hiring systems through evidence-based guidance.

More insights from our research team

Citigroup is eliminating approximately 1,000 positions in January 2026, with additional cuts expected in March targeting managing directors and senior staff. This guide explains what's happening, your options, and how to move forward.

More than 1,000 Health Canada employees have received workforce adjustment notices as part of federal government plans to reduce the public service by approximately 40,000 positions by 2028-29.

More than 1,000 Public Services and Procurement Canada (PSPC) employees have received workforce adjustment (WFA) notices as part of federal government plans to reduce the public service by approximately 40,000 positions by 2028‑29.

Affected by the January 2026 IRS restructuring? This guide covers what happened, your benefits and severance options, and how to plan your next career move.