Key Insight

This guide is for IRS employees affected by the January 2026 restructuring, including layoffs, buyouts, deferred resignations, or RIF actions. It focuses on protecting benefits and planning a thoughtful transition forward.

On January 20-21, 2026, IRS CEO Frank Bisignano announced a major organizational restructuring just days before the 2026 tax filing season began on January 27. The changes reduced the IRS workforce by approximately 26%, from 103,000 employees in January 2025 to roughly 77,000.

The reductions affected multiple divisions across the agency:

- Tax examiners: 27% reduction

- Revenue agents: 26% reduction

- IT workforce: 23% reduction

- Management and analysis staff: 28% reduction

Employees left the agency through several mechanisms. Approximately 4,600 accepted buyout offers in January 2025. Around 17,000 were approved for voluntary early retirement. Roughly 300 were separated through official reduction-in-force (RIF) procedures. Thousands more left through smaller separation programs. About 7,000 probationary employees were laid off and later reinstated on administrative leave.

The restructuring was part of broader federal workforce reductions led by the Department of Government Efficiency (DOGE) under the Trump administration, which began in early 2025.

New leadership appointments accompanied the restructuring. Gary Shapley was named Deputy Chief of Criminal Investigation. Jarod Koopman replaced Guy Ficco as Chief of Criminal Investigation and also became Chief Tax Compliance Officer. Joseph Ziegler was appointed Chief of Internal Consulting.

National Taxpayer Advocate Erin M. Collins warned that the 26% workforce reduction, combined with significant tax law changes, poses risks to the 2026 filing season.

If you received a RIF notice, deferred resignation offer, or were placed on administrative leave, do not sign anything or make irreversible decisions about your benefits until you fully understand your options. The first 30 days are critical for protecting your entitlements.

The first few days after learning about a layoff or restructuring are often the most disorienting. Before making any major decisions, focus on stabilizing your situation and gathering the information you need.

Give yourself space to process

A federal job loss, especially from an agency where many employees have built long careers, affects more than your finances. Acknowledge the disruption. Reach out to colleagues, friends, or family. Consider using your Employee Assistance Program (EAP) if your benefits are still active.

Collect and organize your documents

Gather the following records before your access to agency systems ends:

- RIF notice or separation letter with the official effective date

- Deferred resignation agreement if applicable

- SF-50 (Notification of Personnel Action) showing your separation

- Benefits statements for FEHB, FEGLI, and dental/vision

- TSP statements with current balance and contribution history

- Leave balance records showing accrued annual and sick leave

- Pay stubs from the last several pay periods

- Performance evaluations from recent years

- Position descriptions for roles you have held

- Training certificates and any security clearance documentation

Review any agreements carefully

If you received a deferred resignation offer or buyout agreement, read every provision before signing. Pay attention to:

- Whether you waive any appeal rights

- How severance is calculated and when it will be paid

- What happens to your benefits and when coverage ends

- Any non-disclosure or non-disparagement clauses

Consider consulting with a federal employment attorney or union representative before signing, especially if the timeline feels rushed.

Avoid withdrawing your TSP balance, requesting a FERS refund, or canceling insurance coverage in the first few weeks. These decisions have long-term consequences and should only be made after you understand all your options.

Understanding Your Severance, Benefits, and Federal Entitlements

Federal employees separated through RIF or certain other involuntary mechanisms may be entitled to severance pay, continuation of benefits, and other protections. Understanding what you qualify for is essential before making any decisions.

Severance pay eligibility

You may qualify for severance pay if you meet all of the following:

- You have at least 12 months of continuous federal civilian service

- Your separation is involuntary (not for cause, performance, or resignation)

- You are not eligible for immediate retirement

- You have not declined a reasonable offer of another federal position

Severance is calculated based on your years of service and age. The basic formula is one week of pay for each of your first 10 years of service, plus two weeks of pay for each year beyond 10. An age adjustment factor applies for employees over 40.

Severance is typically paid as a lump sum or in salary continuation installments. How it is paid affects when you become eligible for unemployment insurance, so clarify this with HR.

Health benefits (FEHB)

If you are enrolled in FEHB at the time of separation, you have options:

- Immediate retirement: Coverage continues into retirement with the same government contribution

- Deferred or postponed retirement: You lose coverage but can re-enroll when your annuity begins

- Not eligible for retirement: You may elect Temporary Continuation of Coverage (TCC) for up to 18 months, but you pay 102% of the premium (the full cost plus 2% administrative fee)

Coverage typically ends 31 days after the last day of the pay period in which you separate. Mark this date on your calendar and make enrollment decisions before it passes.

Thrift Savings Plan (TSP)

Your TSP account is yours regardless of separation. You have several options:

- Leave the money in TSP: Your balance continues to grow tax-deferred with the same low administrative fees

- Roll it over to an IRA or new employer's plan: Maintains tax-deferred status

- Withdraw the balance: Subject to income tax and, if under 59½, a 10% early withdrawal penalty in most cases

If you expect to return to federal service, leaving your TSP in place is often the simplest approach. Consult a financial advisor before making any withdrawals.

FERS retirement contributions

If you contributed to FERS but are not yet eligible for retirement, you can request a refund of your contributions. However, doing so has consequences:

- You lose credit for that time if you later return to federal service

- You may owe taxes on the refund

If there is any chance you might return to federal employment, consider leaving your contributions in place. The money does not earn interest, but it preserves your service credit.

Annual and sick leave

Accrued annual leave is paid out as a lump sum upon separation. Sick leave is not paid out, but if you return to federal service or retire under FERS, your sick leave balance can be credited toward your retirement calculation.

Placement assistance and reemployment priority

Federal employees separated through RIF have reemployment priority through the Career Transition Assistance Plan (CTAP) and Interagency Career Transition Assistance Plan (ICTAP). These programs give you preference for federal jobs for which you qualify.

Register with USAJOBS and ensure your profile reflects your RIF status to take advantage of these programs.

Request a written statement from HR that confirms your separation was due to RIF or restructuring, not performance. This document helps when filing for unemployment, explaining the situation to employers, and asserting reemployment priority rights.

How to File for Unemployment as a Federal Employee

Federal employees are eligible for state unemployment insurance (UI) just like private sector workers. The process is administered through your state's unemployment office, not through a federal system.

How to file

Apply through your state's unemployment insurance website or office. You will need:

- Your SF-50 showing the separation

- Recent pay stubs

- RIF notice or other documentation of involuntary separation

- Your Social Security number and banking information for direct deposit

States vary in their requirements and application processes. Most allow online filing and provide guidance for federal employees.

Severance and unemployment timing

How severance pay is structured affects when unemployment benefits begin:

- Lump sum severance: You can typically file immediately, though the lump sum may be considered income for the week it is received

- Salary continuation: You may need to wait until salary continuation payments end before becoming eligible for UI benefits

Check with your state unemployment office for specific rules. Be prepared to explain that your separation was involuntary and due to workforce restructuring.

Benefit amounts and duration

State unemployment benefits vary but typically replace 40-60% of your previous wages up to a maximum weekly amount. Most states provide benefits for up to 26 weeks, though some offer extended benefits during periods of high unemployment.

Federal employees follow the same state rules as private sector workers. Your former federal agency reimburses the state for your benefits, but this happens behind the scenes and does not affect your eligibility.

For federal-specific unemployment guidance, the Department of Labor provides information at unemployment insurance for federal employees.

File for unemployment as soon as you are eligible. There is often a one-week waiting period before benefits begin, and processing can take time. Filing early protects you even if you expect to find work quickly.

Update Your Resume for Federal and Private Sector Roles

IRS experience translates well to both federal and private sector opportunities. However, the resume format and language differ significantly between these two tracks.

For federal resumes (USAJOBS)

Federal resumes are longer and more detailed than private sector resumes. They typically run 3-5 pages and include:

- Full job history with dates, hours worked, and GS level or salary

- Detailed descriptions of duties and accomplishments

- Specific keywords from the job announcement you are applying for

- Supervisory contact information

- Security clearance status

When applying to federal jobs, read the job announcement carefully and mirror its language. Use the exact phrases from the "specialized experience" section to describe your work.

Highlight your tax law knowledge, compliance experience, audit skills, and any investigative work. Mention specific IRS systems you used and the scope of your responsibilities (number of cases, revenue amounts, geographic coverage).

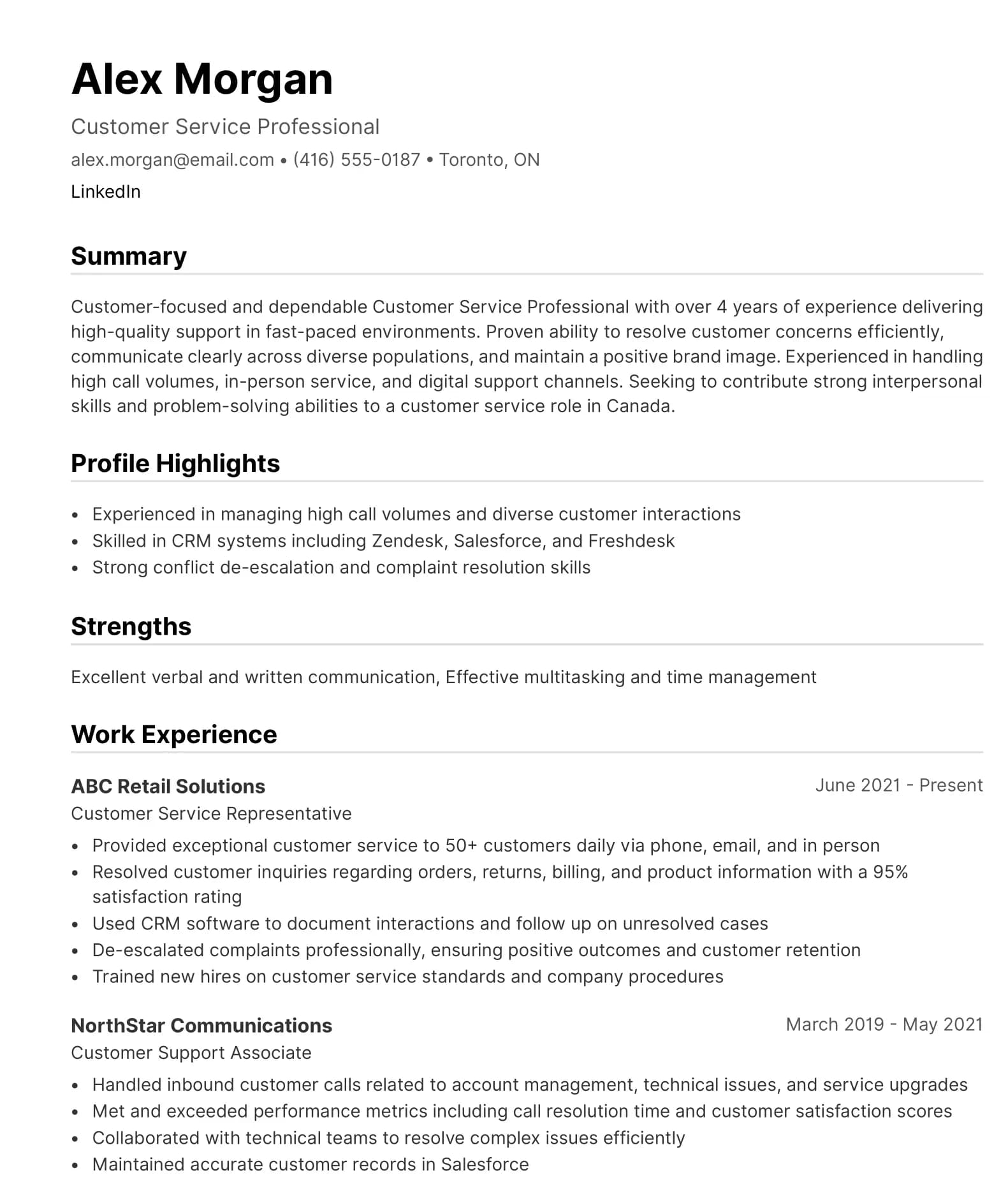

For private sector resumes

For private sector roles, your resume should be concise, typically one to two pages, and written in clear business language rather than federal terminology. The goal is to help employers quickly understand your value without needing to interpret government-specific titles or systems.

Key translations to use include:

- Revenue Agent → Tax Compliance Specialist

- GS-12 Tax Examiner → Senior Tax Analyst

- Examination of returns → Tax audit and compliance review

- Taxpayer contact → Client communication

- Case closure → Audit completion

Remove or clearly explain federal-specific references such as GS levels, series codes, or SF-50s. Instead, focus on transferable accomplishments:

- Number of audits completed or cases closed

- Revenue recovered or assessed

- Efficiency or process improvements you implemented

- Training or mentoring provided to others

- Complex tax issues you resolved

Whenever possible, quantify your impact. Statements like “completed 150 audits annually with a 98% accuracy rate” communicate far more value than general descriptions of responsibility.

Translate your skills

IRS employees develop skills that are highly valued across sectors:

- Tax compliance and audit: Direct relevance to CPA firms, corporate tax departments, and state revenue agencies

- Financial investigation: Applicable to forensic accounting, fraud detection, and compliance roles in banking and insurance

- Regulatory research: Valued in legal, consulting, and policy roles

- Data analysis: Transferable to analytics positions in finance, insurance, and technology

- Stakeholder communication: Useful in client-facing roles and public policy work

Identify which of your skills best match the roles you are pursuing and lead with those in your resume summary.

For guidance on formatting and ATS optimization, the Yotru resume builder can help structure your experience for both federal and private sector applications.

Where to Look Next: Roles and Sectors for IRS Professionals

IRS experience opens doors in both public and private sectors. Understanding where your skills are most valued helps you focus your search.

Federal opportunities

Other federal agencies hire employees with tax, compliance, and financial investigation experience:

- Treasury Department (outside IRS): Financial Crimes Enforcement Network (FinCEN), Office of the Comptroller of the Currency

- Department of Justice: Tax Division, U.S. Attorney offices

- Securities and Exchange Commission: Enforcement and compliance roles

- Federal Deposit Insurance Corporation: Bank examination and compliance

- State revenue agencies: Many states actively recruit former IRS employees

Use your CTAP/ICTAP reemployment priority when applying to federal positions. Set up job alerts on USAJOBS for occupational series that match your experience (512 for tax, 510 for accounting, 1811 for criminal investigation).

Private sector tax roles

The private sector actively seeks former IRS employees for their regulatory knowledge and audit experience:

- Big Four accounting firms (Deloitte, PwC, EY, KPMG): Tax advisory, controversy, and compliance practices

- Mid-sized and regional CPA firms: Tax preparation, audit defense, and consulting

- Corporate tax departments: In-house tax analysts and compliance managers at large companies

- Tax software companies: Intuit (TurboTax), H&R Block, and emerging fintech companies

- Law firms: Tax controversy and estate planning practices

Starting salaries vary widely by role and location. Revenue agents and tax examiners with 5+ years of experience often find private sector roles paying 15-40% more than their federal salary, though benefits packages differ.

Your skills extend beyond pure tax work:

- Compliance analyst in banking, insurance, or fintech

- Internal auditor in corporate or nonprofit settings

- Forensic accountant at consulting firms or government contractors

- Risk management specialist in financial services

- Regulatory affairs professional in healthcare, energy, or finance

Freelance and consulting

Some former IRS employees build independent practices:

- Tax preparation services during filing season

- Enrolled agent (EA) practice representing clients before the IRS

- Consulting for tax controversy and audit defense

- Expert witness work in tax litigation

If you are considering this path, ensure you understand IRS post-employment restrictions on representing taxpayers before the agency.

Former IRS employees are often in high demand at accounting firms during tax season (January-April). Even if you are pursuing a permanent role, seasonal positions can provide income and networking opportunities while you search.

Networking, Explaining Layoffs, and Signaling Your Job Search

How you communicate about your separation affects how employers perceive you. Mass layoffs at federal agencies are well understood, so focus on framing your situation professionally.

LinkedIn post example

If you choose to announce your job search publicly:

After [X] years with the IRS, I was affected by the January 2026 restructuring. I'm now exploring opportunities in tax compliance, audit, financial investigation, and regulatory roles in both federal and private sectors. I bring expertise in [specific areas: tax law, examination, data analysis] and am open to conversations about positions where I can continue contributing to [financial integrity, taxpayer service, compliance systems]. Please reach out if you know of opportunities or would like to connect.

Keep the tone professional and forward-looking. Avoid criticizing the agency or administration.

Interview answer example

When interviewers ask about your separation:

I was part of the January 2026 IRS restructuring, which reduced the workforce by 26% across multiple divisions. It was a broad organizational change, not performance-related. I'm looking to apply my [X years] of tax compliance and audit experience in [sector or role type], and I'm excited about the opportunity to bring my regulatory and investigative skills to [company or organization].

This answer acknowledges the situation directly, clarifies it was not for cause, and pivots to what you offer.

Tap into your networks

- Federal employee associations: NTEU (National Treasury Employees Union), AFGE

- Professional organizations: American Institute of CPAs, National Association of Tax Professionals, Association of Certified Fraud Examiners

- LinkedIn groups: Federal employee job search groups, tax professional communities

- Alumni networks: If you have degrees in accounting, finance, or law

Former colleagues who have already transitioned to private sector roles can be especially helpful for referrals and insight into hiring processes.

For more on building professional connections, see networking strategies that build lasting connections.

Special Considerations for Federal Employees

Several issues are unique to federal employees navigating workforce transitions.

Reinstatement and appeals

If you were a probationary employee who was laid off and then reinstated on administrative leave, clarify your status with HR. Your rights and benefits depend on whether you are technically still employed.

Employees who believe their RIF was procedurally improper can appeal to the Merit Systems Protection Board (MSPB). The Office of Special Counsel (OSC) handles complaints about prohibited personnel practices. Deadlines for appeals are strict, so act quickly if you believe your rights were violated.

Security clearance

If you hold a security clearance, it remains active for a period after separation (typically 24 months for Secret, 24 months for Top Secret). Many federal contractor and private sector roles require clearances, so maintaining yours can be valuable.

Update your SF-86 if you take a new cleared position. Avoid any actions that could jeopardize your clearance status during your job search.

Veterans preference

If you are a veteran with preference status, your preference applies to future federal job applications. Veterans also have additional protections under RIF procedures, so ensure these were applied correctly in your case.

Pension and retirement considerations

Depending on your age and years of service, you may be eligible for:

- Immediate retirement: If you meet the minimum retirement age and service requirements

- Deferred retirement: You leave your contributions in FERS and claim an annuity when you reach eligibility age

- Postponed retirement: Similar to deferred, but with different rules for when you can claim benefits

If you are close to retirement eligibility, calculate whether it makes sense to wait versus accepting severance. The difference in lifetime benefits can be substantial.

Political climate acknowledgment

Federal workforce decisions are shaped by administration priorities. This can feel personal, but focusing on what you control, your skills, your network, and your job search strategy, is more productive than dwelling on factors outside your control.

Many agencies and private firms continue hiring tax professionals regardless of broader federal policy shifts. Your expertise remains valuable.

Mental Health and Community Resources

Job loss affects more than finances. Taking care of your wellbeing during this transition is practical, not optional.

Employee Assistance Program (EAP)

If your EAP benefits are still active, use them. Most programs offer free counseling sessions, financial guidance, and referrals to other resources. Services are confidential.

Federal employee communities

- r/fednews on Reddit: Active community of federal employees discussing workforce issues

- LinkedIn federal employee groups: Professional networking and job leads

- NTEU and AFGE: Union resources for members, including transition support

- Federal Employee Education and Assistance Fund (FEEA): Emergency grants and scholarships for federal employees and families

Framing the experience

A RIF or restructuring is not a reflection of your performance or value. It is an organizational decision driven by factors outside your control. This framing matters not only for how employers perceive you but for how you perceive yourself.

If you find yourself struggling with the transition, professional support can help. The Substance Abuse and Mental Health Services Administration (SAMHSA) National Helpline (1-800-662-4357) provides free, confidential support 24/7.

To move forward practically, the Yotru ATS Resume Builder widget below can help you translate your experience into clear, skills-based language that screening systems and employers can understand.

ATS-Optimized resumes That Meet Employer Standards

Our AI-powered scoring system helps organizations assess and standardize resume quality at scale. ATS-compliant templates support consistent formatting, keyword alignment, and interview readiness across cohorts.