Market

4 min read

Hiring Trends in Quebec for 2026: Tight Labour Supply and Persistent Skills Shortages

Synopsis

Quebec labour market report 2026 with GDP growth (~1.1–1.4%), low unemployment (~5.1%), tight labour supply, and persistent skills shortages.

This article provides a qualitative overview of Quebec’s labour market based on provincial and national labour statistics, economic forecasts, and institutional analysis. It is intended to support understanding and workforce planning rather than formal forecasting. Outcomes may vary by industry, region, and evolving policy or economic conditions.

Quebec enters 2026 with one of the tightest labour markets in Canada. Population aging, slower labour-force growth, and persistent skills mismatches continue to constrain hiring, even as overall economic momentum remains moderate.

This analysis is most relevant to employers, HR leaders, mid-career professionals, training providers, and policymakers planning for Quebec’s labour market in 2026.

1. Low unemployment masks structural labour shortages

Quebec’s seasonally adjusted unemployment rate stood at approximately 5.1% in November 2025, according to Statistics Canada’s Labour Force Survey, remaining below the national average and among the lowest provincially. This tight headline rate reflects limited supply of qualified, French-proficient candidates, rather than a lack of applications overall.

Labour shortages are most acute in:

- Skilled trades and construction

- Healthcare and social assistance

- Manufacturing and industrial maintenance

- Education and early childhood services

- Information technology and digital roles

Demographic pressure, particularly retirements and population aging, continues to reduce available labour supply. Youth unemployment remains higher than the overall rate but lower than in several other provinces, reflecting both tight demand and entry-level experience barriers.

So what

- For candidates: Job prospects are strongest for those with certified, in-demand skills.

- For employers: Hiring difficulty stems from constrained supply, not weak applicant interest.

2. Economic growth is modest, not expansionary

Quebec’s real GDP growth is projected at around 1.1–1.4% in 2026, supported by services, public investment, and manufacturing exports, but constrained by trade uncertainty, elevated interest rates, and productivity challenges.

This environment supports replacement and maintenance hiring, rather than large net employment gains. Employers prioritise continuity, compliance, and output stability.

So what

- For candidates: Stability and role relevance matter more than rapid advancement.

- For employers: Hiring decisions are closely tied to operational necessity.

3. Sectoral demand remains concentrated and persistent

Despite slower growth, hiring demand remains resilient in several structurally important sectors:

- Healthcare and social services: Nurses, personal support workers, allied health professionals

- Skilled trades: Electricians, carpenters, mechanics, HVAC technicians

- Manufacturing and aerospace: Industrial technicians, machinists, engineers

- Information technology: Software, cybersecurity, digital infrastructure roles

- Education and childcare: Teachers and early childhood educators

These shortages are long-standing and unlikely to ease materially in 2026.

So what

- For candidates: Sector targeting materially improves outcomes.

- For employers: Competition for qualified talent remains intense.

4. Language requirements shape hiring outcomes

Quebec’s language framework continues to shape labour-market outcomes. French proficiency is essential for most public-facing, regulated, and professional roles, particularly in healthcare, education, and government-linked employment.

Bilingual candidates are especially sought in Montreal-based professional services, contact centres, technology support teams, and export-oriented SMEs, where client and supplier interactions span multiple markets.

So what

- For candidates: French proficiency significantly expands opportunity.

- For employers: Language requirements narrow the effective talent pool.

5. Wage growth continues but remains moderate

Wage growth in Quebec remains positive but moderate, typically around 3–3.5% nominal, reflecting tight labour supply but constrained employer margins. Real wage gains vary by sector.

Stronger wage pressure persists in:

- Healthcare and social services

- Skilled trades and construction

- Technology and digital roles

In other sectors, employers rely more on job stability, benefits, and work-life balance than aggressive wage increases.

So what

- For candidates: Wage gains are strongest in regulated and skills-scarce roles.

- For employers: Retention depends on conditions and progression as much as pay.

6. Hiring remains selective and experience-driven

Despite low unemployment, hiring in Quebec remains highly selective. Employers prioritise:

- Immediate role readiness

- Recognised credentials and certifications

- Relevant Canadian and Quebec-specific experience

Entry-level hiring remains constrained in many sectors due to training costs and operational pressure.

So what

- For candidates: Demonstrated experience and certification outweigh potential alone.

- For employers: Training pipelines are critical to long-term workforce stability.

7. Training and immigration shape labour supply

Public training programmes, employer-led upskilling, and immigration continue to play an important role in addressing shortages. However, alignment between training outputs and employer needs remains uneven.

Hiring outcomes improve where:

- Training is closely tied to specific occupations

- Credentials are recognised and transferable

- Employers participate directly in workforce development

So what

- For candidates: Accredited, occupation-specific training improves employability.

- For employers: Workforce development is a strategic necessity.

What this means in practice

For job seekers

- Target sectors with persistent shortages (healthcare, trades, IT, education)

- Invest in French-language proficiency and recognised credentials

- Highlight practical, role-specific experience

For employers

- Expect continued difficulty filling skilled and regulated roles

- Plan hiring around replacement needs and productivity

- Invest in training, apprenticeships, and retention

- These dynamics underscore the need for targeted investment in training, upskilling, and bilingual workforce development.

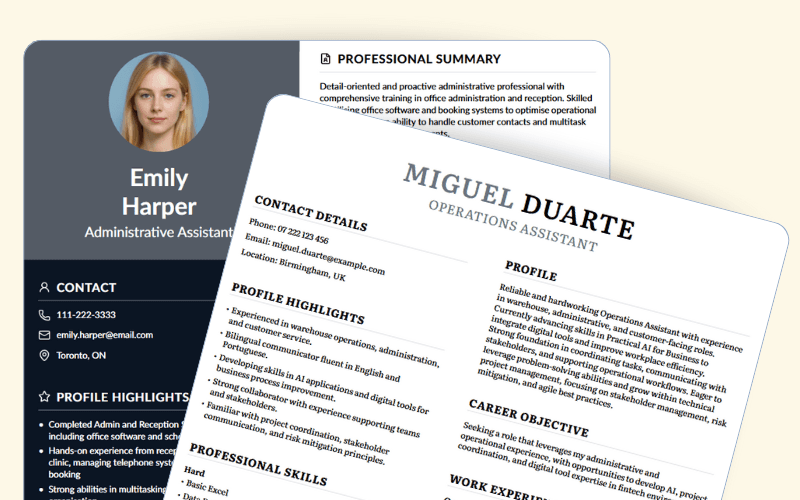

Platforms like Yotru can support these strategies by making skills visible, standardising employer-ready resumes at scale, and helping workforce programs, institutions, and employers in Quebec align candidates’ experience with real job requirements across high-demand roles.

Looking ahead

Quebec’s 2026 labour market reflects low unemployment (around 5.1%), modest growth (around 1.1–1.4%), and persistent skills shortages driven by demographics, language requirements, and sector-specific demand. Hiring continues, but it is selective and experience-driven. Organisations and professionals aligned with regulated skills, bilingual capacity, and long-term workforce development are best positioned to succeed.

All figures cited are indicative and based on publicly available data as of late 2025. Official statistics and forecasts may be revised.

References

Statistics Canada. (2025, December 4). Unemployment rate by province and territory, November 2025 (The Daily). Statistics Canada.

https://www150.statcan.gc.ca/n1/daily-quotidien/251205/mc-a001-eng.htm

YCharts. (2025). Quebec unemployment rate (monthly). YCharts.

https://ycharts.com/indicators/quebec_unemployment_rate

Ministère des Finances du Québec. (2025, November). Update on Québec’s economic and financial situation – Fall 2025. Government of Québec.

https://www.finances.gouv.qc.ca/Budget_and_update/maj/documents/AUTEN_updateNov2025.pdf

Institut de la statistique du Québec. (2025). Employment and unemployment rates by administrative region. Institut de la statistique du Québec.

https://statistique.quebec.ca/en/produit/tableau/monthly-indicators-employment-and-unemployment-rates-by-administrative-region

Job Bank. (2025, October 22). Quebec – job market snapshot. Government of Canada.

https://www.jobbank.gc.ca/trend-analysis/job-market-reports/qc/job-market-snapshot

About the Author

Team Yotru

Employability Systems & Applied Research

Team Yotru

Employability Systems & Applied Research

We bring expertise in career education, workforce development, labor market research, and employability technology. We partner with training providers, career services teams, nonprofits, and public-sector organizations to turn research and policy into practical tools used in real employment and retraining programs. Our approach balances evidence and real hiring realities to support employability systems that work in practice. Follow us on LinkedIn.

Questions or Need Support?

If you are working on employability programs, hiring strategy, career education, or workforce outcomes and want practical guidance, you are in the right place.

Yotru supports individuals and organizations navigating real hiring systems. That includes resumes and ATS screening, career readiness, program design, evidence collection, and alignment with employer expectations. We work across education, training, public sector, and industry to turn guidance into outcomes that actually hold up in practice.

Contact Yotru

Continue Reading

More insights from our research team

Ottawa Job Cuts: What to Do If You’ve Received a Workforce Adjustment Notice

Facing a workforce adjustment notice in Ottawa’s public service? Learn what it means, your options, and how to prepare your resume, interviews, and next career steps.

3 min read

Ontario Job Posting Law 2026: Salary Range, AI Disclosure and Record Requirements

For Ontario employers, recruiters, and staffing agencies. A clear guide to the 2026 job posting law changes, including salary disclosure, AI transparency, and record-keeping rules.

5 min read

What to Do Next After the Perley Health Job Cuts

Facing a layoff in health care after the Perley Health job cuts? Learn practical steps to stabilize your career, update your resume, prepare for interviews, and find new opportunities.

2 min read

Why Canva and Word Fail at Scale for Learner CVs

For training providers managing many learners, common CV tools create inconsistency, review bottlenecks, and risk. This article explains why Canva and Word struggle at scale and what breaks first.

3 min read